Public Sector Banks Merger Issues and Necessities – PSB Bank Merger | Public Sector Banks Merger Pros and Cons

The banking sector has reported a national loss of 25 thousand crore rupees owing into 10 defaulting companies failing to pay loan they had borrowed from financial institutions. This after banks wrote off one lakh forty four thousand ninety three crore bad loan in the financial year 2017-18. A massive 61 point eight point increase from the previous year and of the total write offs for 2017-18, one lakh twenty thousand one hundred sixty five crore bad loans were written off by public sector banks.

In addition PSB suffered a loss of 87 thousand crore rupees in the fiscal year that ended 31st Mar 2018. The losses were primarily due to higher provisioning towards NPA and losses in the bond portfolio. Four banks accumulated a massive loss of 21 thousand crore rupees in last financial year. So as part of its consolidation plan, the government is now considering merging these banks which are these banks being proposed to be merged with the merger will the government be able to stem the rise in bad loans.

In April 2017, the government had merged SBI with five of its associate bank and the Bhartiya Mahila Bank. Now if the proposed merger of four state-run banks goes as planned, the merged entity will become the second largest bank in the country with combined assets of 16.58 trillion rupees.

Bad Loan of Indian Banks

- More than Rs 8 crore bad loans of 38 commercial banks at the end of June 2019 quarter.

- Bad loans account for nearly 11% of total loans given by banking industry.

- Over 90% bad loans on the books of government owned banks.

- PSBs wrote off Rs 1.20 lakh crore bad loans in current FY 2018.

- SBI wrote off bad loans of Rs 40,196 crore in 2017-18.

What is a bad bank?

- Bad bank is an entity that buys NPAs from banks.

- Then it works to recover, turnaround assets through professional management, sale or restructuring.

- A committee set up to look at the feasibility of setting up a new asset reconstruction company or asset management company to take over bad loans of PSBs.

- At present year of 2019, 11 PSBs under RBI’s Prompt Corrective Action (PCA) framework on account of poor performance.

- PCA imposes various curbs like stopping branch expansion, halting dividend payments, limiting loan limits, audit and restructuring.

Amid rising bad loans and losses, some public sector banks are fast losing their relevance. In such a situation, the only option before the government is to either shut these banks or merge them with stronger banks. However by choosing the option of merger, the government feels that it will encourage a broader consolidation in the banking industry. The decision to merge PSU bank was taken in the meeting of the Union Cabinet under the chairmanship of Prime Minister Narendra Modi. Objective of the merger is to create stronger banks. Apart from this, merger could also reduce their dependence on government for capital. Government is also intend to make these bank self-reliant. Under this scheme, the government is considering of IDBI, Central Bank, Bank of Baroda and Oriental Bank of Commerce. According to an official data in 2017-18, these four banks posted their combined staggering loss of around 22000 crore rupees. However post merger, the total assets of new bank comprising these four banks are epected to be 16.58 lakh crore rupees.

PSU Banks : Mounting Losses

Bank of Baroda

- Reports Rs 3,102 Cr loss for March quarter of 2017-18 for provisioning bad loans.

- This provision for NPAs jump 190% in March quarter.

IDBI Banks

- Reports net loss of Rs 5662.76 Cr in March quarter.

- Gross NPA ratio rose to 27.95% in Dec quarter.

Private Sector Banks in India

- 10 private banks opened up between 1980 to 2000.

- Increasing competition among banks to provide better services to customers.

- ATMs, mobile banking, SMS alerts, internet banking made available.

- 2 new private banks began to operate in 2001.

At present, there are 21 public sector banks and 22 private sector banks and 56 Regional Rural Banks across India. State run banks control approximately 70% of the country’s banking market with an increase in the number of private banks. The gap of profit and loss has relatively reduced.

Private vs Public Sector Banks

- FY 2012-13 : Profits per employee of private banks between 10.6% to 12.4%. While in case of government bank, profits per employee was 5.5% to 7.00%.

- Salaries of private bank employees is more than that of employees in PSBs.

- Huge scarcity of employees in government owned banks.

- In recent years, thousands of PSBs staff shifting to private sector banks.

- Growth rate of government banks is much lower than that of private banks in sanctioning loans.

- 0.6% increase in PSBs in rate of interest in March 2017.

- Credit Growth Rate at 17% in private banks.

- Private banks way ahead in terms of deposits.

- March 2017 : Deposit growth of govt banks was 6.5%, private banks settled at 19.6% growth.

Bank merging is necessary because rise in NPA reduces the ability of banks to grant loans. The work of bank is to deposit money and provide loans which is source of income for banks. Banks can thinks of other measures to provide loan. Right now, the option available for banks is to either to merge or shut down. Basel Norms 1, 2, 3

There is also a major cause of worry for the common people who deposit money in these banks. A common man deposits his hard-earned money in banks, banks then use this capital to give out loans to people in needs and to businesses and industries hoping to get the borrowed amount back from the individual or business in the form of EMI. However when this loans does not come back to the bank, it goes into the categories of non-performing assets or NPA. According to the banking rules when the EMI of any loan, principal amount or interest does not come within 90 days of due date, it is put in the NPA category. In other words, when a bank fails to get returns on loan, it becomes an NPA or a bad loan.RBI HISTORY

Types of NPA

NPA broadly can be divided into three types,

Sub-standard Assets

- Asset that remains NPA for a period less than or equal to 12 months.

- Difficult to recover entire dues.

- Bank has to maintain 15% of its reserves.

Doubtful Assets

- Asset which has remained NPA for a period exceeding 12 months.

- Likelihood of recovering entire amount very less.

- Loss identified by the bank, internal or external auditor or central bank inspectors.

- Amount has not been written off, wholly or partly.

Standard Asset

- If the debtor pays his outstanding interest and principal amount, then the NPA is put in the standard loan category. Its meaning that the loan is being paid back on time.

- In order to convert NPA in standard category, the bank often try to settle the debt by giving the more time to the debtor to pay the outstanding amount and lowering the interest rate.

- Apart from this, there is a provision to prevent NPA for which the banks have special mention account (SMA). In these accounts, one month’s installment and the outstanding interests are placed so that they can be washed and potential NPA accounts can be prevented from being transformed into NPA.

History of Bank Mergers

According to the Indian banking association figures 49 mergers big and small have taken place in the country since 1985.

- April 2017 : State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore and Bharatiya Mahila Bank merged with the State Bank of India.

- 2010 : State Bank of Indore merged with SBI.

- 2008 : State Bank of Saurashtra merged with SBI.

- 2004 : Oriental Bank of Commerce and Global Trust Bank merged.

- 1993-94 : Punjab National Bank and New Bank of India merged.

- Hindustan Commercial Banks merger with P and B Kashi. State Bank merger with the SBI. Banaras State Bank merger with the Bank of Baroda. HDFC’s acquisition of Centurion Bank of Punjab and the merger of Kotak Mahindra Bank with ING Vyasa.

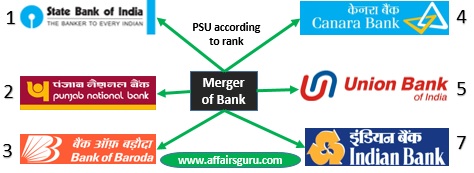

SBI : State Bank of Hyderabad, State Bank of Travancore, State Bank of Patiala, Bhartiya Mahila Bank, State Bank of Bikaner & Jaipur, State Bank of Mysore. (Business size – 52.05 lakh crore rupees) => The largest

Important Banking Terminologies For Bank Exams

Bank of Baroda (1st April 2019) : Bank of Baroda, Vijya Bank and Dena Bank (Business size – 16.13 lakh crore rupees) => 3rd largest

August 2019 : 10 public sector banks to be merged in 4 PSBs.

PNB : PNB + Oriental Bank of Commerce + United Bank (Business size – 17.94 lakh crore rupees) => Second Largest

Canara Bank : Canara Bank + Syndicate Bank (Business size – 15.20 lakh crore rupees) => 4th Largest

Union Bank : Union Bank + Andhra Bank + Corporation Bank (Business size – 14.59 lakh crore rupees) => 5th Largest

Indian Bank : Indian Bank + Allahabad (Business size – 8.8 lakh crore rupees) => 7th Largest

Banking Reforms

- Two committee under M Narshimhan, former RBI Governor.

- Narshimham Committe I of 1991 and Narshimham Committe II of 1998.

- PJ Nayak Committee recommended merger of PSBs and their privatization.

Rationale of merger : There should not be any disruption to the customers and hence we are ensuring that the banks which are merging that they operate on the same technological platform, said by Finance Secretary Rajeev Kumar.