Punjab National Bank Scam- How it was executed? Is Nirav Modi responsible?

Full Media Report

- Nirav Modi and the $1.77-billion PNB fraud.

- Punjab National Bank (PNB), the country’s second-largest public sector lender, is now in the middle of Rs. 11,400 crore transaction fraud case.

- On Wednesday morning (7th February 2018), PNB informed the Bombay Stock Exchange that it has detected some “fraudulent and unauthorised transactions” in one of its branches in Mumbai to the tune of $1771.69 million (approx).

- Following this announcement, the share price of the State-owned bank plunged 10%.

- Meanwhile, the Central Bureau of Investigation(CBI) received two complaints from PNB against billionaire diamanaire Nirav Modi and a jewellery company alleging fraudlent transactions worth about Rs. 11,400 crore, the Press Trust of India reported.

- This is in addition to the Rs. 280 crore fraud case that Nirav Modi is already under investigation for, again filed by PNB.

Who is Nirav Modi?

- Nirav Modi, the billionaire in the middle of this controversy, is a luxury diamond jewellery designer who was ranked #85 in the Forbes list of India’s billionaires with $1.8 billion in 2017.

- He is the founder and creative director of the Nirav Modi chain of diamond jewellery Firestar International, the parent of the Nirav Modi chain, which has stores in key markets across the globe.

- His business spans whole world, not only India.

- His designs have been worn to the Oscars by ‘Hidden Figures’ star Taraji P. Henson and to the Golden Globes by Dakota Johnson, among others. Actor Priyanka Chopra is the brand ambassador.

The Modus Operandi?

- In a statement issued to stock exchanges on Wednesday(7th February 2018), PNB said that it has detected some “fraudulent and unauthorised transactions (messages)“.

- A stock statement is a business statement that provides information on the value and quantity of stock related transactions. It details opening and closing balances for transacted items as well.

- According to the complaint filed by PNB with the CBI on January 28, the fraudulent issuance of Letters of Undertakings (LOU) was detected at the Mid Corporate Branch, Brady House in Mumbai.

What are major differences between SME, mid-corporate(MCB) and large corporate branch(LCB)?

- SME branches focus on credit limit upto Rs. 5 crore.

- Mid Corporate branches(MCB) give credit upto Rs. 50 crore.

- Large Corporate branches(LCB) have large credit exposure of major corporate clients with credit limit of Rs. 50 crore and more.

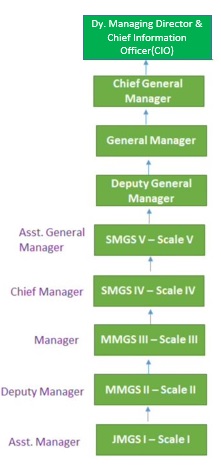

- SME and Mid Corporate branches are headed by AGM.

- While Large Corporate branches are headed by DGM and above, depending on Bank business.

Designation Level

Letter Of Undertaking

- A contract perform the promise, or discharge the liability, of a third person in case of his default. Example, I, Neha Sharma goes to the any branch of Bank of India and asks for Letter of Undertaking from Bank. Bank of India provides this facility after doing the formality.What is role of Letter of Undertaking for us? If I go to the Axis Bank located in Hongkong and Neha has taken the Loan or Credit from the Axis Bank after showing the Letter of Undertaking. If I, Neha Sharma doesn’t repay the loan to the Axis Bank, then Bank of India has to give the Loan or Credit(Buyer Credit) to the Axis Bank in Hongkong. It is like a guarantee but not bank guarantee.

- Inter-Bank

- High Provisioning i.e. Risky

- Bank takes high Charges from Customer

- Buyer credit is a short term credit available to an importer(buyer) from overseas lenders such as banks and other financial institution for goods they are importing.

- A set of partnership firms – Diamond R US, Solar Exports and Stellar Diamonds – approached the bank on January 16 with a set of import documents and requested for Buyer’s Credit to make payments to overseas suppliers.

- The firms have Nirav Modi, his brother Nishal Modi, Mr. Nirav’s wife Ami Nirav Modi, and Mehul Chinubhai Chokshi as partners.

- As there was no sanctioned limit in the name of the firms, the branch officials requested the firms to furnish 110% cash margin for issuing the LOU for raising the Buyer’s Credit.

- At this, the firms contested that they have been availing this facility in the past, but the branch records do not corroborate this.

- On digging further, the bank officials discovered that two of its employees had fraudulently issued LOUs in the past without following prescribed procedures and approvals.

- The employees had then transmitted SWIFT instructions to the overseas branches of Indian banks for raising Buyer’s Credit without making entries in banking system to avoid detection.

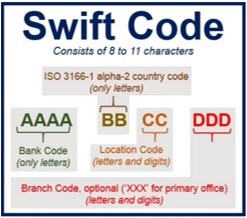

SWIFT Code

- It is unique code like IFSC code in bank.

- Stands for Society for Worldwide Interbank Financial Telecommunication code. An Internationally-recognized identification code for banks around the world.

- SWIFT codes are most commonly used for international wire transfers and are comprised of 8 or 11 alphanumeric charatcters.

- The International Organization of Standardization (IOS) was the authoritative body that approved the creation of SWIFT codes.

- The complaint also said that the funds so raised for the payment of the Import Bills have not been utilised for such purposes in many cases.

- As per the FIR, five of the SWIFT messages (SWIFT is a messaging network used by financial institutions to securely transmit instruction) were issued to Allahabad Bank in Hong Kong and three to Axis Bank in Hong Kong.

What will happen now ?

- One of the worrying aspects of the scam is that in its statement, PNB says that based on the fraudulent transactions, other banks appears to have advanced money to the customers abroad.

- It goes on to add that these transactions are contingent in nature and any liability arising out of these on the bank will have to be decided based on the law and genuineness of underlying transactions.

What is a ‘Contingent Liability’?

- A contingent liability is a potential liability that may occur, depending on the outcome of an uncertain future event.

- A contingent liability is recorded in the accounting records if the contingency is probable and the amount of the liability can be reasonably estimated.

- If both of these conditions are not met, the liability may be disclosed in a footnote to the financial statements or not reported at all.

- Meanwhile, Joint Secretary in Department of Financial Service Lok Rajan said “I don’t think this is out of control or too big a worry at this point. That is my broad sense.”

Department of Financial Services

- The Department of Financial Services covers Banks, Insurance and Financial Services provided by various government agencies and private corporations.

- It also covers pension reforms and Industrial Finance and Micro, Small and Medium Enterprise. It started the Pradhan Mantri Jan Dhan Yojana.

- PFRDA, Pension Fund Regulatory and Development Authority (PFRDA) is a statutory body which also works under this department.

- Rajiv Kumar is the current Secretary of this department.

Scam

- However, the Rs. 11,400 crore scam comes at a time when the Central government is attempting to provide a breather to ailing PSBs, having announced a Rs. 2.11 lakh crore capital infusion to the sector in October 2017.

- For this year, PNB will receive Rs. 5, 473 crore as capital infusion from the government through a mix of recapitalisation bonds and direct infusion.

- As of now, as Reuters (An international news agency founded in London in 1851 by Paul Julius Reauter(1816-99)) opined, the only good that could come out of the affair would be some fresh consideration to implementing better practice in public sector banking.

All the best for your exam!!

You can join or visit at Facebook Page or Twitter for always keep in touch with further updates

Read more articles….